Indian Bank Explained: Indian Bank is one of India’s leading public-sector banks, established in 1907 with its headquarters in Chennai. It offers a wide range of banking services, including savings accounts, loans, digital banking, and financial products for individuals, businesses, and government organizations. Indian Bank plays a crucial role in the country’s financial inclusion initiatives, serving millions of customers across India. In 2020, it merged with Allahabad Bank, strengthening its position in the banking sector. Known for its customer-centric approach, Indian Bank has both domestic and international presence, with over 5,900 branches and 5,268 ATMs across the country.

INDIAN BANK

Indian Bank Apprenticeship 2025-26

Indian Bank Recruitment 2025-26 Advt No. Apprentices Act, 1961 for F.Y 2025-26 : Short Information Below

| Important Dates | Application Fee |

|

The fee must be paid online during the application process, and the payment can be made using a Debit/Credit card or Internet Banking. Make sure to save the e-receipt of the payment for future reference. |

Age Limit (as on 01.07.2025)

-

-

Minimum Age: 20 years

-

Maximum Age: 28 years (as of 01.07.2025)

-

Relaxation in Age:

-

SC/ST candidates: 5 years

-

OBC candidates: 3 years

-

PwBD candidates: 10 years

-

Widows/Divorced Women: Age relaxation up to 35 years for General/EWS, 38 years for OBC, and 40 years for SC/ST.

-

-

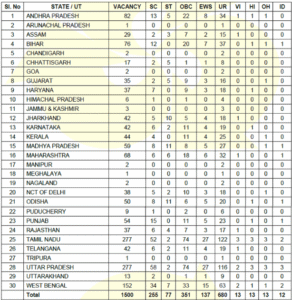

Indian Bank Apprenticeship 2025-26: Vacancy Details Total : 1500 Post

| Post Name | Total Post | Eligibility |

|---|---|---|

|

Clerk Probationary Officer (PO) Specialist Officer (SO) Assistant Manager |

1500 |

Educational Qualification: Minimum Qualification: Graduate Degree in any discipline from a recognized university or equivalent. Completion of Graduation: Candidates should have passed their graduation on or after 1st April 2021. Nationality/Citizenship A candidate must be a Citizen of India or fall under one of the following categories: Subject of Nepal or Bhutan. Tibetan Refugee who came to India before 1st January 1962 intending to settle permanently. A person of Indian origin who has migrated from Pakistan, Burma, Sri Lanka, East African countries, etc. |

Indian Bank Apprenticeship 2025-26: Category Wise & State Wise Vacancy Details

|

Indian Bank Apprenticeship 2025-26: Selection Process |

|

The selection for the apprenticeship will consist of two main stages: 1. Online Test

2. Local Language Proficiency Test (LLPT)

|

Indian Bank Apprenticeship 2025-26: How to Apply |

|

A. Application Registration

B. Payment of Fees

C. Photograph, Signature, Left Thumb Impression & Handwritten Declaration Upload

Important Points Before Registration

Submission of Application Once all the fields are filled and documents are uploaded, submit the application form. Important Reminder: Keep your Provisional Registration Number and Password secure, as you will need them for future steps, such as downloading call letters or checking the status of your application. |

Some Useful Important Links |

|

| Apply Online | Click Here |

| Download PDF | Click Here |

| Join Sarkari Naukri Channel | Telegram | WhatsApp |

| Official Website | Click Here |

Conclusion: The Indian Bank Apprenticeship Program 2025-26 is an excellent opportunity for graduates to enhance their skills and gain valuable work experience in the banking sector. With 1500 vacancies, this is a chance to start a rewarding career in one of India’s most respected banks.

If you’re a fresh graduate looking for an apprenticeship, make sure you apply before 7th August 2025. Remember to follow all the guidelines carefully, and best of luck with your application!

For more updates, keep checking the official Indian Bank Careers page.

FAQs Indian Bank Apprenticeship 2025-26

What is the duration of the Indian Bank Apprenticeship?

The Indian Bank Apprenticeship is for a fixed duration of 12 months. During this period, apprentices will receive on-the-job training at various branches of Indian Bank.

2. How can I apply for the apprenticeship program?

To apply, candidates must register on the NATS Portal, complete the application form on the Indian Bank website, and submit required documents (photograph, signature, thumb impression, and handwritten declaration). The application must be submitted online between 18th July 2025 and 7th August 2025.

3. What is the application fee for the Indian Bank Apprenticeship?

-

General/OBC/EWS candidates: ₹800 + GST

-

SC/ST/PwBD candidates: ₹175 + GST

The fee must be paid online during the application process.

4. What is the stipend for apprentices in the program?

The stipend is based on the branch location:

-

Urban/Metro Branches: ₹15,000 per month

-

Rural/Semi-Urban Branches: ₹12,000 per month

5. What happens after the apprenticeship period?

The apprenticeship is meant to provide practical experience and skill development. There is no guarantee of permanent employment with Indian Bank after the apprenticeship, though apprentices will receive a Certificate of Proficiency after completing the training successfully.